Best Liability Insurance for Northeast Physicians

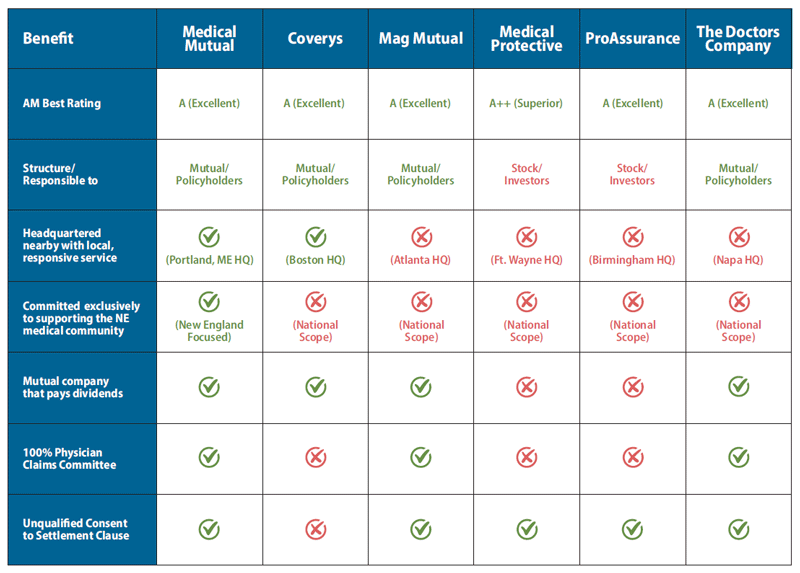

Considering physician malpractice insurance options in New England? When you look closely, there’s no comparison.

The advantages of Medical Mutual are easy to see

Find out why Medical Mutual, now offering coverage in MA, has a 99% retention rate.

Medical Mutual Insurance Company of Maine — the dominant carrier in Northern New England for 46+ years — offers physicians and independent practices competitively priced, custom policy options with these significant advantages:

- Stable, competitive rates (no rate hikes in the past 5 years).

- Claims committee comprised 100% of experienced physicians who know the medicine and understand your perspective — unlike other malpractice insurance carriers, whose business orientation sometimes leads to claims decisions based on cost-benefits analyses. If the medicine met the standard of care, we’ll spend what it takes to defend you and your reputation.

- The most comprehensive set of FREE risk management tools and programs in the marketplace, including on-site risk assessments, on-site and web-based education and a robust library of online practice tips.

- Unlimited consultations with our professional risk managers — go-to people with whom one or more employees in your organization are likely to forge a productive working relationship.

- Flexible payment plans including the industry’s only 9-month installment plan.

More proof that Medical Mutual Insurance Company of Maine is your ideal medmal carrier: the many advantages of a partnership with us.

For most carriers, medical professional liability insurance is a transactional business. They sell the policy, then simply sit back and react if and when a claim requires them to engage on your behalf. That’s it. Nothing more.

With Medical Mutual, you’ll enjoy a dedicated protection partnership with a group of people who are not only conscientious but engaged on your behalf.

You’ll forge relationships with key people in the company. People who share your concern for patient safety. People you won’t hesitate to call directly to get insightful guidance when you have questions that impact anything from coverage options to handling a potential claim to strategies for managing specific risks in the care environment.

Even the Management team, shown here, is

engaged on your behalf in what most member policy holders

consider a protection partnership,

rather than a vendor-client relationship.

This information and counsel is an integral policy

feature that can be worth many thousands of

dollars every year. Yet in the spirit of partnership,

you get them free for being a member-policyholder

of Medical Mutual.

Even the Management team, shown here, is

engaged on your behalf in what most member policy holders

consider a protection partnership,

rather than a vendor-client relationship.

This information and counsel is an integral policy

feature that can be worth many thousands of

dollars every year. Yet in the spirit of partnership,

you get them free for being a member-policyholder

of Medical Mutual.

Peer review of claims: A peerless advantage

Should you suffer a significant claim, that’s when the full meaning and impact of your partnership with Medical Mutual will feel invaluable. That’s because it will be evaluated not by businesspeople who are likely to view the settle vs. defend question as a financial decision, but by a Claims Committee comprised entirely of experienced physicians.

They know the care environment and the standards of care.

Most importantly, as your peers, they understand the value of your reputation.

Operating independently of Company management, you can be certain their recommendations are based on the medicine, period.

Consent to settle: it’s up to you

Medical Mutual will not settle any claim or suit on your individual policy without your consent, an important feature that clearly protects your interests by giving you ultimate control over whether or not a claim is settled on your behalf.

Physician’s Administrative Defense Coverage: when risks beyond malpractice threaten your livelihood

Physician Administrative Defense (PAD) is a feature of your medical professional liability insurance policy you can take advantage of should you be the subject of a disciplinary proceeding in front of a government licensing board, a hospital board, or any other organization that can curtail, suspend or revoke your ability to practice. Like most carriers, Medical Mutual provides coverage, subject to limits, for legal consultation and defense costs related to administrative disciplinary proceedings. Again, differences arise, however, in how Medical Mutual and other carriers treat such situations.

Group Policies: same coverage, simpler administration

Medical Mutual group policies offer the same coverage as individual policies, while offering significant administrative efficiencies and other advantages. With a policy in a group’s name, there is a single policy with one set of invoices and one common effective date — as opposed to separate invoices for each physician, arriving at various times because of differing individual effective dates. All providers retain their own retro-active date and their own individual limits, but administration is simpler due to the streamlining of redundant paperwork into a single transaction.

Group difference driven by logic

Because premiums are billed to and paid by the group, return premiums go to the group and not the individual. Group policies cover only claims arising out of professional services which fall under an individual physician’s scope of duties as an employee or contractor of the group, though optional coverage for practice outside the group is available.

The most notable difference of a group policy is that the Consent to Settle provision rests with both the physician involved and the practice manager, administrator, or other person identified by the group to act on their behalf. That is, both the physician and the group’s designated representative must agree to settle a case on behalf of the physician. This provides the group with an additional source of risk management in identifying key issues while providing the physician with another opinion and support for his or her decision. Other differences do exist. For details, contact your agent or the Medical Mutual Underwriting Department.

Slots, prior acts options for groups

In a medical jobs market that is ever more fluid, with regular turnover in certain employee positions, more and more groups are taking advantage of a Medical Mutual option that allows you to insure a "slot" rather than an individual. This eliminates the need to worry about an expensive credentials check for that slot every time a physician, nurse or other specialty care provider arrives or moves on.

Excess Insurance

Should you desire coverage over and above the limits of Medical Mutual’s standard professional liability insurance policy, we offer an extra layer of coverage in the form of umbrella excess insurance. So you get the higher limit(s) you desire to protect against catastrophic cases and judgments.

Locum Tenens

If you notify Medical Mutual prior to a planned absence, protection may be available while your practice is covered by another health care provider.

Discounts

Premium discounts are offered for:

- Loss-Free Experience — you can earn a 1% discount per year of loss-free experience while insured by Medical Mutual; this discount is capped at 15%

- Longevity — you can earn a 1% discount per year of continuous membership with Medical Mutual; this discount is capped at 10%

- Part-Time Practice — health care providers in part-time practice

- New Doctor — residents entering private practice for the first time may be eligible

- Leaves of Absence

- Other Factors which mitigate the risk of loss or facilitate administration.

Non-Assessable Policy

You cannot be assessed back-charges if prior years’ rates are proven to have been inadequate.

These are just some of the major advantages you’ll enjoy with Medical Mutual medmal protection.