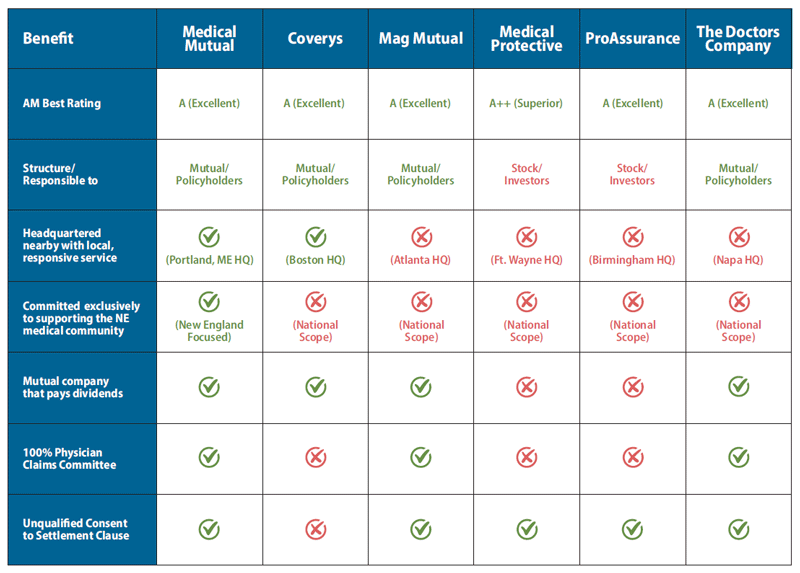

The advantages of Medical Mutual are easy to see

Medical Mutual Insurance Company of Maine — the dominant carrier in Northern New England for 46 years — now offers Massachusetts physicians and independent practices a competitively priced occurrence policy with these significant advantages:

- Stable, competitive rates (no rate hikes in the past 5 years).

- Claims committee comprised 100% of experienced physicians who know the medicine and understand your perspective — unlike other malpractice insurance carriers, whose business orientation sometimes leads to claims decisions based on cost–benefits analyses. If the medicine met the standard of care, we’ll spend what it takes to defend you and your reputation.

- The most comprehensive set of FREE risk management tools and programs in the marketplace, including on–site risk assessments, on–site and web–based education programs and a robust library of online resources.

- Unlimited consultations with our professional risk managers — go–to people with whom one or more employees in your organization are likely to forge a productive working relationship to prevent systemic errors.

- Flexible payment plans including the industry’s only 9–month installment plan.

More proof that Medical Mutual Insurance Company of Maine is your ideal

Massachusetts medmal carrier: the advantages of a partnership with us.

As you may have experienced in Massachusetts — for most carriers, medical professional liability insurance is a transactional business. They sell the policy, then simply sit back and react if and when a claim requires them to engage on your behalf. That’s it. Nothing more.

Medical Mutual offers you a committed partnership with a team that is both attentive and invested in your needs.

You’ll build connections with professionals who

prioritize patient safety just as much as you do. These are people you can reach out to directly for expert

advice, whether it’s about coverage choices, addressing potential claims, or implementing risk management

strategies in your care setting.

You’ll build connections with professionals who

prioritize patient safety just as much as you do. These are people you can reach out to directly for expert

advice, whether it’s about coverage choices, addressing potential claims, or implementing risk management

strategies in your care setting.

The management team, pictured here, is actively involved in what most member policyholders view as a true protection partnership, rather than a typical vendor-client arrangement.

The expert advice and guidance they provide, which could be valued at thousands of dollars annually, are offered as a core benefit of your policy. As a member-policyholder with Medical Mutual, you receive this support at no extra cost, reflecting our commitment to partnership.

If you’ve met the standard of care, our 100% physician Claims Committee will recommend that you fight the claim all the way through trial if that’s what it takes to defend you and your reputation.

Among medical malpractices carriers in New England, and perhaps anywhere, it’s an advantage you’ll only find with Medical Mutual.

Peer review of claims: A peerless advantage

Should you suffer a significant claim, that’s when the full meaning and impact of your partnership with Medical Mutual will feel invaluable.

That’s because it will be evaluated not by businesspeople who are likely to view the settle vs. defend question as a financial decision, but by a Claims Committee comprised entirely of experienced physicians.

They know the care environment and the standards of care.

Most importantly, as your peers, they understand the value of your reputation. Operating independently of Company management, you can be certain their recommendations are based on the medicine, period. And, we’ll never take action without your consent.

These are just some of the major advantages you’ll enjoy with Medical Mutual’s Massachusetts medmal protection.