Explore the Premier Choice for Physician Malpractice Insurance in New England

As healthcare leaders, your focus is on safeguarding your institution’s reputation and maintaining the highest standards of patient care. When it comes to physician malpractice insurance, the choice should align with these priorities. Medical Mutual Insurance Company of Maine, now extending our coverage to Massachusetts, stands as the dominant provider in Northern New England with a 99% retention rate—a testament to our unwavering commitment to our policyholders.

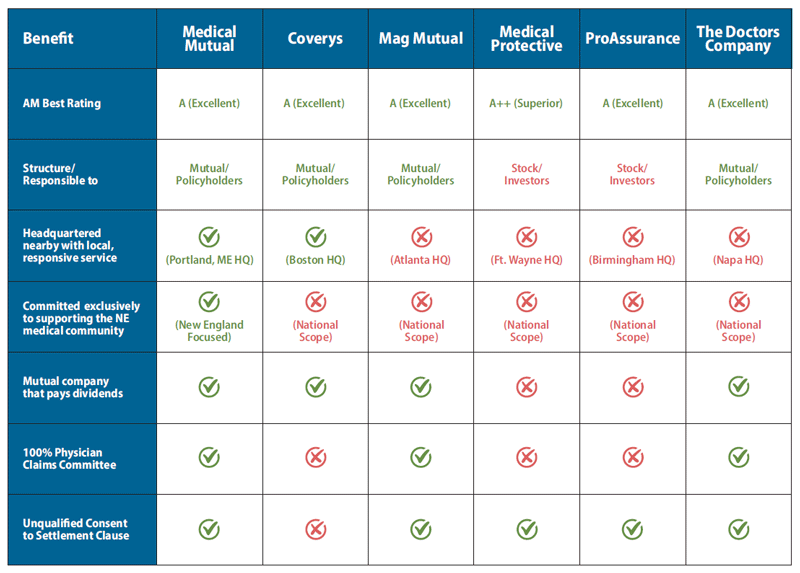

The advantages of Medical Mutual are easy to see

For over 46 years, we have partnered with healthcare organizations and independent practices, offering competitively priced, custom policy options that cater to your specific risk management needs. Here’s why Medical Mutual is the strategic choice for healthcare executives:

- Stability in Pricing: Our rates have remained stable with no increases over the past five years, ensuring predictable budgeting for your institution.

- Expert-Driven Claims Process: Our claims committee is composed entirely of experienced physicians who understand the complexities of medical practice. Unlike other carriers driven by cost-benefit analyses, we are committed to defending your practitioners when the standard of care has been met, regardless of cost.

- Comprehensive Risk Management Resources: We provide the most extensive set of complimentary risk management tools in the industry, including on-site risk assessments, both in-person and web-based education, and a robust online library of practice tips.

- Dedicated Professional Risk Managers: Establish direct relationships with our risk management experts, who are readily available to provide guidance tailored to your organization’s unique needs.

- Flexible Financial Options: Benefit from our unique payment structures, including the industry’s only 9-month installment plan, designed to accommodate the financial cycles of healthcare institutions.

Strategic Partnerships with Our Policyholders

At Medical Mutual, we view our relationship with you as a strategic partnership, not just a transactional arrangement. Our commitment goes beyond merely providing insurance; we actively engage with your team to ensure comprehensive protection and proactive risk management. This collaboration enables you to focus on what matters most—delivering exceptional patient care.

Our management team is not only accessible but deeply invested in the success of your organization. By choosing Medical Mutual, you gain more than a policy—you gain a partner who understands the intricacies of the healthcare environment and stands ready to support you in navigating the complexities of medical liability.

Discover the Medical Mutual Advantage

We invite you to experience the difference that a true partnership can make in your malpractice coverage. With Medical Mutual, you are not just a policyholder; you are a valued partner in a shared mission to enhance patient safety and uphold the highest standards of medical care.

Ready to explore how we can support your organization’s needs? Contact us today to compare rates and receive a personalized quote. Let’s build a partnership that fortifies your institution’s commitment to excellence.

A Full Array of Coverages, Limits, and Options

Medical Mutual provides a comprehensive array of coverages, limits, and options to meet all your medical professional liability needs, including excess coverage and innovative slot coverage. This unique slot coverage insures positions staffed by multiple physicians, ensuring shared protection and reducing the need for costly tail coverage.

Claims-Made Coverage

All Medical Mutual professional medical liability insurance coverage is written on a claims-made basis. This ensures that your hospital is protected for claims arising from covered professional services provided after your initial effective date (or retroactive date) of coverage. Claims filed today are covered by current policy limits, even if your limits were lower at the time of the incident.

Typical coverage includes:

- Failure to provide healthcare services

- Furnishing of food, beverages, medications, or appliances

- Post-mortem care

- Lawful activities of accreditation, credentialing, and quality assurance committees

- Reasonable defense costs up to $250 per day

rShare Risk Sharing Program

The rShare risk sharing program offers ultimate flexibility, allowing you to select from indemnity-only, expense-only, or combined deductibles starting as low as $5,000 per claim up to hundreds of thousands of dollars. Larger hospitals and systems can also choose Co-Participation, taking on a larger share of the risk for greater savings on the base premium.

Excess Insurance

For coverage above the limits of Medical Mutual’s standard professional liability insurance policy, we offer umbrella excess insurance. This provides the higher limits necessary to protect against catastrophic cases and judgments.

Unique Slot Coverage

In the fluid medical jobs market, slot coverage allows hospitals to insure a position rather than an individual. This eliminates the need to purchase tail coverage each time a slotted provider moves on, with the obligation arising only if the slot is closed entirely.

Physicians Administrative Defense (PAD)

Our base policy includes PAD coverage for named physicians employed by your hospital, specifically for disciplinary actions brought by the State Board of Licensure. This coverage protects both the physician and the hospital, safeguarding care delivery operations and reputations.

General Liability Insurance

Medical Mutual’s integrated general liability coverage helps close potential gaps between professional and general liability. This avoids finger-pointing by ensuring seamless coverage. The general liability portion is written on an occurrence basis, covering claims for incidents that occur while the policy is in force, regardless of when the claim is filed.

Coverage includes:

- Bodily injury

- Property damage

- Personal injury

- Medical payments for premises claims up to $5,000

- Fire legal liability

- Patient's personal property ($1,000 limit/$100 deductible)

Discounts

Experience-based premium discounts are available, with program and protocol requirements for qualification. Contact your agent or the Medical Mutual Underwriting Department for further information.

Non-Assessable Policy

Our policy ensures that you cannot be assessed back-charges if prior years’ rates are proven inadequate.

For more information on customizing a program based on your unique risk tolerances and business challenges, please contact Medical Mutual today.